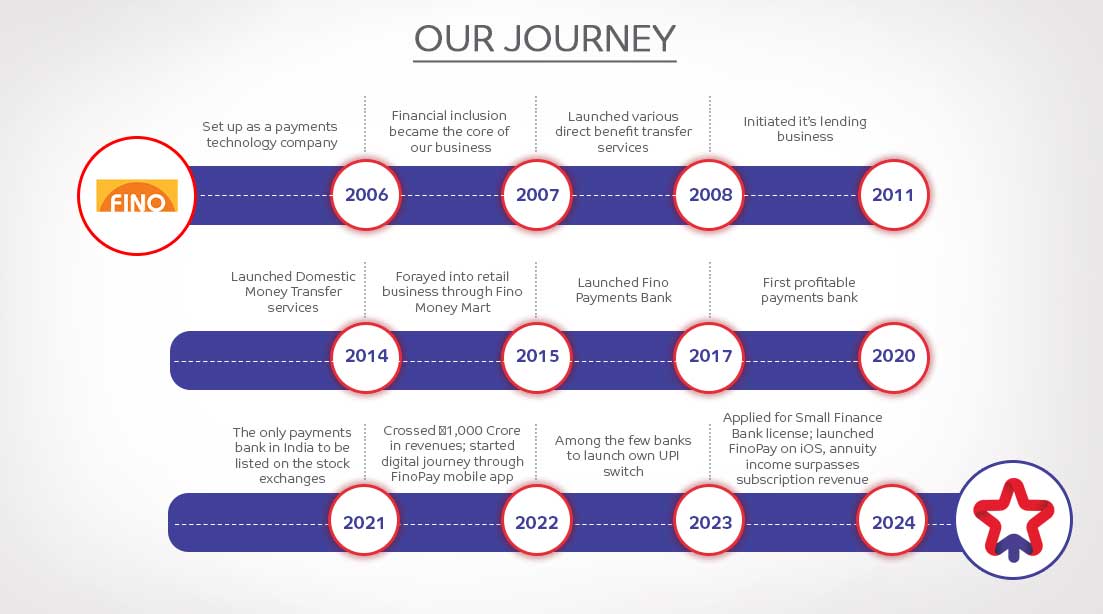

The start of Fino’s payments bank journey in 2017 was a transformative moment for all of us. Today, as I reflect back I feel proud of what we have achieved. Your Bank’s business grew over 6x times - from ₹230 crores revenue in FY 2017-18 we closed FY 2023-24 with ₹1,478 crores with PAT of over ₹86 crore!

Our consistent and sustainable journey not only echoes on the incredible progress we have made this far but also sets stage for an exciting future for your Bank. We are in the midst of another phase of transformation, the beginning of our digital journey where your Bank made remarkable strides. This, in short, describes the financial year 2023-24 for Fino.

As the world’s most populous country, demographics in Bharat support India’s further growth. We are now the 5th largest economy globally. This rapid growth brings new opportunities, particularly for companies like ours that are integral to the financial and digital infrastructure of Bharat.

Our role in fostering financial inclusion and supporting the digitization of the rural economy has never been more significant. We are proud to have contributed to a significant leap in financial inclusion—nearly 90% of Indians who are aged 18 years and above now have a bank account, up from just 58.7% a decade ago. However, our mission does not end with providing access. The real challenge now lies in deepening engagement and making banking an everyday convenience in the remotest parts of Bharat.

Rural India is transforming as aspirations rise. The widespread adoption of digital banking, particularly through platforms like UPI, is a testament to the growing trust in formal financial systems and initiatives of the Government towards digitisation. At Fino, we are excited by the possibilities this digital revolution presents, and we are committed to accelerating our journey from inclusion to innovation.

Bharat is at epitome of its growth for next decade and we as Fino are in a sweet spot given our products, services, distribution network and hold in rural economy to ride the wave and grow exponentially from hereon.

I am proud to share that your Bank has achieved remarkable financial success over the last year:

- Total revenue increased by 20% to ₹1,478 crores, reflecting our commitment towards consistent growth trajectory.

- Profit after tax grew by 32%, reaching ₹86 crores, underscoring the strength of our structured operational model.

- Our total transaction throughput surged by 41% to ₹3.58 lakh crores, driven by an ever-growing number of transactions, which increased from 121 crores to 211 crores, a 75% year-on-year growth.

- Your Bank now facilitates almost ₹1,000 crore worth of transactions per day.

- Digital contributed 37% to the overall transaction throughput, almost double from 19% in FY 2022-23.

- UPI transaction volume on your Bank’s platform accounted for 1.27% of the total UPI ecosystem transaction volume in Q4 FY24. This increased to 1.42% in Q1 FY25 and continues to grow.

This success is a testament to our resilience, innovation and ability to adapt to changing market dynamics with robust technology as its backbone.

Differentiated strategies

We have been consistently and persistently following our TAM (Transaction, Acquisition, Monetization) strategy. This three-phase approach has helped us build a strong foundation with embedded thrust to deliver results consistently.

In the initial phase of Transaction, we focused on growing our base by expanding asset light network and offering services like remittances and cash withdrawals. As of today, your Bank has a network of over 18 lakh merchants across the country that attract around 2.5 crore plus unique footfalls every month. In FY 2023-24, the combined physical network and digital platforms facilitated 211 crore transactions, a remarkable 75% year-on-year growth.

The second phase of Acquisition focuses on customer ownership — converting the footfalls into Fino customers, where occasional transaction users become Fino account holders. I am pleased to report that we added approx. 32 lakh new customers in FY 2023-24 taking our customer base to 1.1 crores as of 31st March 2024.

My optimism for future growth resonates with Monetization which is yet to begin. Over the years, we have built valuable assets, including our merchant network, customer trust and fintech partnerships. The future lies in leveraging these assets to introduce additional financial products through our growing data analytics capabilities, will be key to identifying target customers, developing relevant offerings and further enhancing customer experience.

Our digital and technology initiatives, through Fino 2.0 project, will be the pivot during monetisation phase. Our increasing digitally active customers (currently around 40% of CASA base), demand for B2B digital payment services and the advantage of the proprietary UPI switch to manage rising transaction volume augurs well for your Bank’s business. We are committed to continuous investments in technology to upgrade systems and IT infrastructure for enhancing capabilities and maintaining business momentum by providing agile, simplified and flexible solutions to our customers and partners.

Our future growth will be driven by our focus on 3D (Distribution, Data, and Digitalization):

- We continue to expand our distribution network, ensuring that financial services are accessible to the last mile across Bharat. Our network now covers 97% of India’s PIN codes, providing a comprehensive footprint for both physical and digital service delivery.

- By harnessing the power of data analytics, we have improved customer retention, enhanced risk framework, and increased cross sell. Data-driven insights are helping us make informed decisions, further enhancing our customer experience.

- Our digital impetus has given us a new revenue stream and a unique positioning for growth

As MD and CEO, let me emphasize that your Bank continues to apply highest standards of governance and risk mitigation for business growth. In the digitally driven business environment the banking risk landscape is changing. As opportunities and volumes increase so do regulatory expectations of monitoring every financial transaction. Fino has always adopted “compliance first” and continues to invest in tools, technology and people for implementation of risk mitigations through effective automations / data analytics. The Bank has a well-established and comprehensive compliance framework and structure to identify, monitor and manage the compliance risk, and shall remain committed to further strengthen its compliance framework, lead efforts in responsible banking, and create a long lasting impact.

As a next step transitioning into a Small Finance Bank (SFB) will be a natural progression for us. We have already applied for the transition into SFB with the Reserve Bank of India, and this will enable us to offer a broader range of products, including credit, to our customers.

Our asset-light model, combined with our focus on technology, data analytics, and low-cost funds, gives us a competitive edge in the SFB space. We are confident that we can redefine the traditional SFB model by leveraging these strengths, thereby reinforcing Fino as a different bank in the differentiated space.

Further, our holding company i.e. Fino Paytech Ltd, has requested our Board to explore appropriate options for simplifying the group structure. This strategic initiative is intended to streamline our group's organizational structure and foster long-term value creation. Accordingly, the Bank’s Board has constituted a Committee to explore the possibility of group corporate restructuring and evaluate the implications and other considerations of the same. The group corporate restructuring proposal, as and when approved by the Board, remains subject to approvals and consents as may be required from the regulators, statutory bodies and relevant stakeholders under applicable law.

To summarise

Going forward, we are well-positioned to capitalize on the immense opportunity that lies before us. Our goal is to continue driving financial inclusion, deepening customer engagement, and sustaining growth and profitability through our proven Transaction-Acquisition-Monetization model. Together, we are building a future where digital financial inclusion is a reality for all, and I am excited for the journey ahead. It is apt to say that Bharat is growing, and your Bank Fino is growing exponentially.

On this note, on behalf of management team and the entire Fino family, I extend my deepest gratitude to our valued shareholders, board members, partners and all the other stakeholders for their continued trust and support.